How to Create an Effective Business Exit Strategy: Key Steps and Tips

After years of building your business, you might be ready for a new chapter—whether that is switching to a new venture, taking a long hiatus, or simply retiring. But what about your business, which you built with your blood and sweat? Planning an exit strategy is the solution, providing you with the peace of mind that the business will continue to operate while you enjoy your mojito on an island.

How to exit the business that you have built?

- Three exit strategies

- Sales

- Succession

- Merger

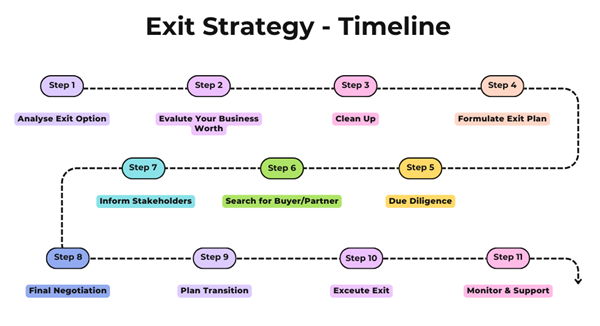

- Timeline for an exit strategy

- Analyze exit option

- Evaluate your business worth

- Clean up your financials and operations

- Formulate an exit plan

- Due diligence

- Search for buyer/ partner

- Inform stakeholders

- Final negotiation

- Plan transition

- Execute exit

- Monitor and support

There are several ways to exit your business, all of which require a clear plan and a timeline. This is a crucial aspect of the process, as it ensures a smooth transition and the best possible outcome for you and your business.

1. Selling Your Business

If you are ready to let go of your business, you can sell 100% ownership to a new buyer. Naturally, you might feel a sense of sadness or loss, but don’t get sidelined. Ensure you achieve the best possible outcome for yourself and the business you built over many years.

2. Passing on Your Business through Succession

You might pass your business to someone you trust to reduce your emotional burden. It could be a trusted family member or a capable employee. This strategy ensures continuity of business while maintaining its legacy and values. However, meticulous succession planning well before your retirement is required to ensure a seamless handover and sustained success.

3. Combining Businesses through Merger

The third exit strategy could be combining your business with another business to create a synergy. You will still have some control over your business and numerous other benefits, such as pooled resources, increased market presence, and operational efficiencies. A merger can be a powerful way to expand your business while allowing you to reduce your involvement or exit entirely.

Regardless of your chosen exit strategy, having a well-defined action plan and adhering to a set timeline is essential. Allocate 6 to 12 months to formulate and execute your exit strategy. The key steps that you will need to follow within this timeframe are:

Step 1: Analyze exit option

Evaluate various exit options and select the one that aligns with your personal goals and business objectives. This could be selling it outright, merging with another business, or succession to a trusted individual. Do consider the pros and cons of each option.

Step 2: Evaluate your business worth

Before locating a potential buyer or partner, you need to determine the worth of your business. This is necessary to set realistic expectations and negotiate a reasonable price.

Step3: Clean up your financials and operations

Ensure that your accounting records are up-to-date, and your business operation is running smoothly. This will help make your business more attractive to potential buyers or partners. Further, it will ensure no hiccups when executing the exit strategy.

Step 4: Formulate an exit plan

Develop a detailed exit plan outlining the timeline, key milestones, responsible person, and required resources. Remember to focus on the specific objective the exit strategy aims to achieve.

Step 5: Due diligence

Carry out thorough due diligence to identify and address any potential issues that could affect the implementation of the exit strategy. This includes reviewing legal documents, financial statements, operations, and compliance matters.

Step 6: Search for buyer/ partner

Once everything is sorted out, search for a suitable buyer or partner. Ensure that their values and visions align with yours to give you peace of mind. If your exit strategy involves a merger, finding a partner whose values and goals complement your own is essential.

Step7: Inform stakeholders

Transparency helps manage expectations and facilitates smoother transition. Hence, communicate your exit plan to key stakeholders such as employees, customers, suppliers, etc. Be prepared to address their concerns about how the changes will impact on them and secure their full support throughout the process.

Step 8: Final negotiation

Conduct final negotiations with the buyer, partner, or successor to finalize the terms and conditions. To prevent potential disputes, ensure that all agreements are clearly defined and legally enforceable.

Step 9: Plan transition

Create a detailed transition guide with a communication strategy to inform all relevant stakeholders about the process and their roles. To ensure they are fully equipped, provide comprehensive training for the new owner/ partner on business operations, processes, and systems. Additionally, a support system should be established to address any issues that may arise before, during, and after the transition period.

Step 10: Execute exit

Execute your exit strategy by completing the sale, finalizing the merger or implementing the succession plan. This entails fulfilling all the contract's legal and financial terms and conditions.

Step 11: Monitor and support

After the exit, monitor the transition's progress and offer support as needed. The goal is to ensure the business continues successfully and smoothly, even in your absence.

Take action now! If you're considering your next steps and want expert guidance on planning your exit strategy, contact us at +61 410 7770 802 or email admin@byogroup.com.au to ensure a smooth transition and the best outcome for your business.

Frequently Asked Questions (FAQ)s:

- What are the most common exit strategies for a business?

The three most common exit strategies are selling the business outright, succession planning (passing it to a trusted individual), and merging with another business to create synergies while reducing personal involvement. - How long does it take to plan and execute an exit strategy?

Typically, you should allocate 6 to 12 months to formulate and execute a well-defined exit strategy, which includes evaluating options, cleaning up financials, and finding a suitable buyer or successor. - What steps should I take to prepare my business for sale or succession?

Key steps include evaluating your business’s worth, cleaning up financials and operations, conducting due diligence, creating a transition plan, and informing stakeholders to ensure a smooth process.